child tax credit payment schedule for october 2021

Appreciated assets including long-term appreciated stocks or property is generally deductible at fair market value not to exceed 30 of your adjusted gross income. For Tax Year 2021 the credit can be worth up to 3600 per child in 2017 and earlier tax years the.

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Additional information about the IRS portal allowing you to follow update or even opt-out of the new payments will also be provided.

. While retroactive payments were made or caught-up for stimulus checks missing eligible payments for the CTC were. Learn what the changes are who qualifies payment amounts and when those payments will be issued. Heres who will get up to 1800 per child in cash and who will need to opt out.

See Important Updates on the Advance Child Tax Credit Payment for Tax Year 2021. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP.

Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax. Despite three rounds of dependent stimulus checks and the advance monthly child tax credit CTC paid in 2021 many tax payers are still waiting to be paid and are relying on their 2021 tax filing to get missing payments for their eligible dependents. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. By Aimee Picchi July 8 2021 710 AM. 2021 Child Tax Credit.

It is a now a fully refundable tax credit and you can qualify even if you had no earned income. Also for Tax Year 2021 Tax Returns your cash donation to a public charity cannot exceed 60 of your AGI or adjusted gross income in order to be deductible on your income tax return.

50 Free Excel Templates To Make Your Life Easier Updated February 2022 Excel Templates Statement Template Invoice Template Word

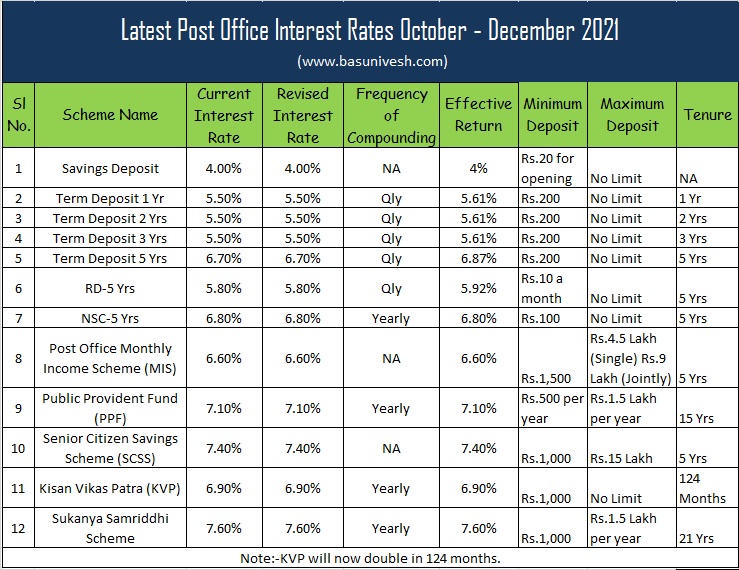

Latest Post Office Interest Rates October December 2021 Basunivesh

Beneficiary Voices Should Be Central To Ngo Story Image Gathering Fundraising Gathering The Voice

Physical Verification Is Necessary For Gst Registration Physics Registration Legal Services

Tupperware Hostess Rewards Tupperware Party Rewards Free Tupperware Tupperware In St Louis Hostess Rewards Hostess Tupperware

A Child Spends More Time In School Than At Home On A Typical School Day But Still There Are Various Life Skills Tha Investing Money Life Skills Things To Sell

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Fake Medical Bill Generator And Electronic Invoice Template Bill Template Medical Billing Invoice Template

Tatkal Ticket Booking Aadhar Card Application Note One Time Password

Benefits Payment Schedule December 2021 January 2022

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account Property Tax Accounting Investors

Welcome You Are Invited To Join A Webinar Csc Etp 創業起步business Start Up After Registering You Will Receive A Confirmation Email About Joining The Webin Small Business Development Starting A Business

Pin By Zecurin Insurance On Insurance Marketplace Insurance 10 Things Health

Wipe Clean Workbook Uppercase Alphabet In 2021 Uppercase Alphabet Workbook Cleaning Wipes

Latest Post Office Interest Rates October December 2021 Basunivesh

Get Out The Complete Annotated Screenplay Inventory Press In 2022 Screenplay Kindle Reading Jordan Peele